ACCOUNTING PERIODS AND METHODS SOLUTIONS TO PROBLEM MATERIALS. 10 Accounting method: timing of deduction New. Are an income-producing factor to the business.

The cash method and the accrual method (sometimes called cash basis and accrual basis) are the two principal methods of keeping track of a business's income and expenses. In most cases, you can choose which method to use. Learn how they work and the advantages and disadvantages of each so you can choose the better one for your business. Camtasia Studio 8 Crack Utorrent. In a nutshell, these methods differ only in the timing of when transactions, including sales and purchases, are credited or debited to your accounts. Here's how each works: The cash method.

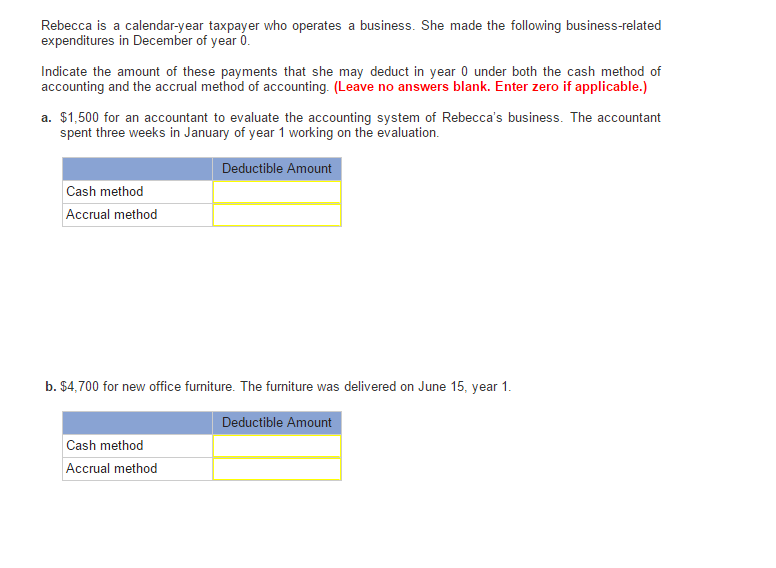

The cash method is the more commonly used method of accounting in small business. Under the cash method, income is not counted until cash (or a check) is actually received, and expenses are not counted until they are actually paid. Example You purchase a new laser printer on credit in May and pay $1,000 for it in July, two months later. Using the cash method, you would record a $1,000 payment for the month of July, the month when the money is actually paid. Under the accrual method, you would record the $1,000 payment in May, when you take the laser printer and become obligated to pay for it.

The accrual method. Under the accrual method, transactions are counted when the order is made, the item is delivered, or the services occur, regardless of when the money for them (receivables) is actually received or paid. In other words, income is counted when the sale occurs, and expenses are counted when you receive the goods or services.

In this post we will take you through 10 essential steps of small business accounting. Accrual Method: Revenues and expenses are. Claim business income on your. Chapter 1 Business Income, Deductions, and Accounting Methods SOLUTIONS MANUAL Discussion Questions.

You don't have to wait until you see the money, or actually pay money out of your checking account, to record a transaction. Determining the Transaction Date With the accrual method, sometimes it's not easy to know when the sale or purchase has occurred. The key date is the job completion date. When to record income. Not until you finish a service, or deliver all the goods a calls for, do you record the income in your books. When to record an expense.

Likewise, you don't record an item as an expense until the service is completed or all goods have been received and installed, if necessary. (If a job is mostly completed but will take another 30 days to add the finishing touches, technically it doesn't go on your books until the 30 days pass.) Choosing an Accounting Method When you can choose either method. Most small businesses (with sales of less than $5 million per year) are free to adopt either accounting method.

When you must use the accrual method. You must use the accrual method if: • your business has sales of more than $5 million per year, or • your business stocks an inventory of items that you will sell to the public and your gross receipts are over $1 million per year. Inventory includes any merchandise you sell, as well as supplies that will physically become part of an item intended for sale. Whichever method you use, it's important to realize that either one gives you only a partial picture of the financial status of your business. Advantages and disadvantages of the accrual method. While the accrual method shows the ebb and flow of business income and debts more accurately, it may leave you in the dark as to what cash reserves are available, which could result in a serious cash flow problem. For instance, your income ledger may show thousands of dollars in sales, while in reality your bank account is empty because your customers haven't paid you yet.